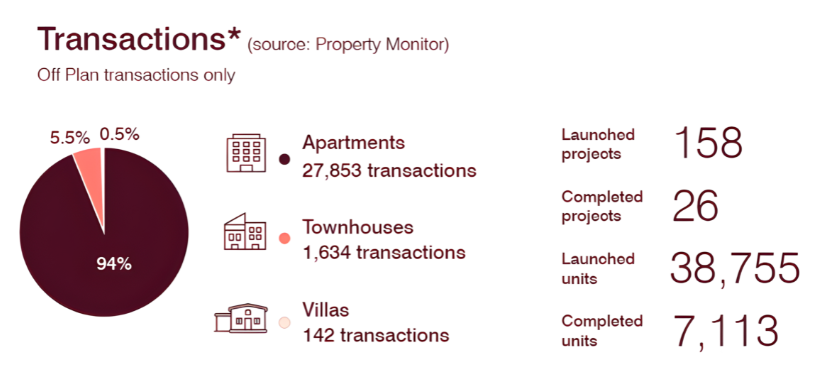

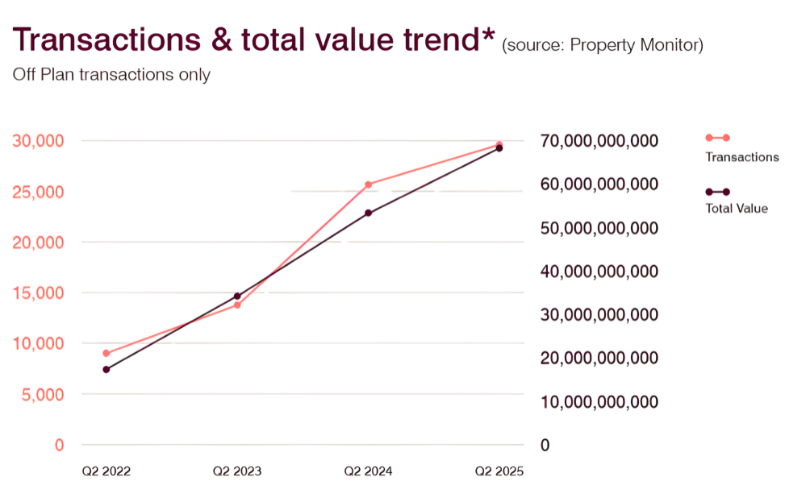

Dubai’s Off Plan market record For Q2 2025 demonstrated exceptional strength in the second quarter of 2025 (Q2 2025), recording a total of 29,629 transactions. This significant figure marks a robust 16.4% increase compared to the same period in the previous year, highlighting accelerating demand from both domestic and international investors and end-users. While apartment sales accounted for the highest volume of transactions, reflecting broad market participation, villa communities stood out by leading in price growth. This disparity indicates a clear shift in buyer preference towards larger spaces and greater exclusivity, driving a premium on luxury, low-density housing within the emirate.

This market activity was underpinned by favorable economic conditions, which resulted in a 7.5% rise in the average price per square foot, reaching AED 1,983. This sustained appreciation is fundamentally driven by Dubai’s rapid population growth and continuous, large-scale infrastructure expansion. The confidence in future growth, fueled by the city’s ability to attract global talent and investment, ensures that strong investor and end-user appetite remains locked into the Off-Plan market, solidifying the sector’s role as a major catalyst for Dubai’s overall economic expansion.

Compared to Q1 2025, the Off Plan market in Q2 accelerated strongly with transaction volume increasing from 24,899 to 29,629 (+19.0%). This means way more properties were sold! The total sales value rising from AED 53.83 billion to AED 67.92 billion (+26.2%). That’s a massive jump in the total amount of money spent. The significant increases in transaction volume and total sales value indicate sustained demand and absorption rates, as well as a healthy market expansion. Basically, people are buying quickly, and the market is growing well.

This quarter, apartments remained the dominant product by volume, representing over 94% of all Off Plan transactions. Apartments are still the most popular thing to buy. However, demand for spacious layouts continues to accelerate, with a significant rise in transactions for properties with 5+ bedrooms. Even with apartments being popular, people are looking for bigger places, like properties with five or more bedrooms.

The AED 5-10M bracket recorded the fastest growth from Q1 to Q2 of 2025, with a 74.7% increase and a significant 107.8% increase from Q2 2024. Properties priced between 5 and 10 million Dirhams saw the biggest surge in sales. The AED 10M+ bracket has also seen a substantial increase in transactions, with 55.6% QoQ and 79.9% YoY growth. Even the super-expensive properties (over 10 million Dirhams) are selling much faster. These sharp increases underscore the explosive rise in big-ticket Off Plan investments, driven by both affluent end-users and global investors targeting space, exclusivity and long-term capital preservation. This shows that wealthy people and international investors are buying expensive properties, looking for large homes, luxury, and a safe place to put their money for the long run.

Population Growth and Property Investment in Dubai

The Dubai population has grown by 102,590 residents in the first 6 months of 2025. That is a lot of new people moving to the city in just half a year!

While rental yield has dipped slightly from 7.12% in June 2024 to 6.83% in June 2025, Dubai continues to outperform major cities worldwide, which typically see a yield of 2-5%. “Rental yield” is basically how much money you earn back from rent compared to what you paid for the property. Even though it went down a little, Dubai is still much better for landlords (people who own property and rent it out) than almost any other major city in the world.

Buyers are increasingly positioning their investments in projects with premium unit quality, amenities, accessibility and community planning. This means people who are buying property aren’t just looking for a cheap place; they want high-quality homes, great features (like pools or gyms), easy access to places, and well-designed neighborhoods. They are investing in the best of the best.

Top Developers by Off Plan Sales

Emaar leads the way for another quarter in sales value, albeit with a smaller lead. Emaar is still the number one company for selling property, even though their lead isn’t as big as it used to be.

Meraas is the highest climber now sitting 2nd, with Sobha Group and Sobha Realty securing two spots in the top 10. Meraas has moved up the fastest and is now in second place. Also, two companies named “Sobha” (Sobha Group and Sobha Realty) are both in the top 10 list.

The top 8 developers all crossed the AED 2 billion transaction line reflecting a diversified offering. This means that the top eight property companies each sold over 2 billion Dirhams worth of property. This also shows they are selling many different kinds of properties, not just one type.