Dubai continues to attract global investors with its world-class infrastructure, tax-free lifestyle, and investor-friendly policies. Dubai Residency visa One of the most appealing pathways for foreigners is obtaining residency through property investment. Whether you’re seeking a secondary home, a profitable rental property, or simply want to gain residency in a thriving global city, Dubai offers multiple visa options tied to real estate ownership.

In this article, we break down the process step by step.

Step-by-step Guide to Getting a Dubai Investor Visa

Securing residency in Dubai is now an opportunity made possible. That’s why Dubai has many designated freehold areas for foreigners, making it easier for anyone to settle in, maximise returns and build a profitable future.

1. Know Your Dubai Residency visa Options

Dubai offers several types of visas linked to real estate investments. The most common options include:

a. 2-Year Property Investor Visa

- Minimum investment: AED 750,000

- Property must be ready (not off-plan)

- Joint ownership allowed (minimum AED 750K per investor)

b. 10-Year Golden Visa

- Minimum investment: AED 2 million

- Property can be off-plan, completed, or mortgaged (equity must be AED 2M+)

- Offers long-term stability and flexibility

c. 5-Year Retirement Visa (For investors aged 55 and above)

- Requires ownership of AED 1 million worth of property

- Additional financial criteria apply

2. Select a Qualifying Property

To qualify for a residency visa, your property must meet certain conditions:

- Located in a freehold area

- Must be residential (villa, apartment, townhouse)

- Have a title deed issued by the Dubai Land Department (DLD)

- Fully paid, unless applying for the Golden Visa (which accepts mortgaged property if equity ≥ AED 2M)

Note: You can combine the value of multiple properties under your name to meet the minimum investment threshold.

3. Complete the Purchase

Purchase the property through legal and regulated channels:

- Use a DLD-registered real estate agent or broker

- Ensure the transaction is done via an official escrow account

- Once finalized, obtain the title deed

This document is essential for your visa application.

4. Apply for the Residency Visa

After obtaining your title deed, you can proceed with the visa application process:

- Visit the Dubai Land Department or an authorized application center (e.g., Cube Centre)

- Submit the required documents:

- Original title deed

- Copy of passport

- Passport-size photographs

- Bank statements (for Golden Visa applicants)

- Property valuation report, if requested

- Complete a medical fitness test and biometric scanning for Emirates ID

- Pay applicable government and visa processing fees

(Fees typically range from AED 15,000 to AED 20,000 for the 2-year visa)

5. Receive Your Residency

Once approved, you’ll receive:

- Your residency visa stamped in your passport

- A valid Emirates ID

- Permission to live in the UAE during the visa’s validity period

Residency is renewable, provided you continue to meet the minimum investment requirements.

Common Questions

Can I rent the property I invested in?

Yes. Property owners can lease their units and still qualify for the residency visa.

Can I sponsor my family members?

Yes, you can sponsor your spouse, children, and dependents under your residency.

Do I need to live in the UAE full-time?

No. However, to keep your visa valid, you must not stay outside the UAE for more than 6 consecutive months.

Is there a minimum income requirement?

Only for certain visa types like the Golden Visa or Retirement Visa, where proof of financial stability may be required.

Conclusion

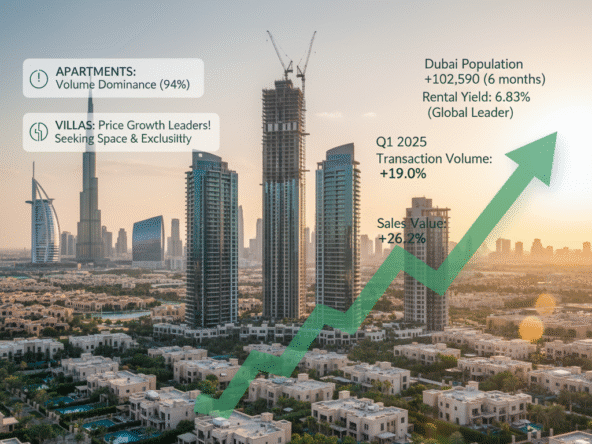

Dubai’s property-linked residency programs offer a seamless and rewarding pathway for investors seeking residency in one of the world’s most dynamic cities. With options tailored for short-term investors, long-term planners, and retirees, there’s flexibility for every profile.

Whether you’re investing for lifestyle, business, or returns, securing Dubai residency through real estate is one of the smartest moves in today’s global market.