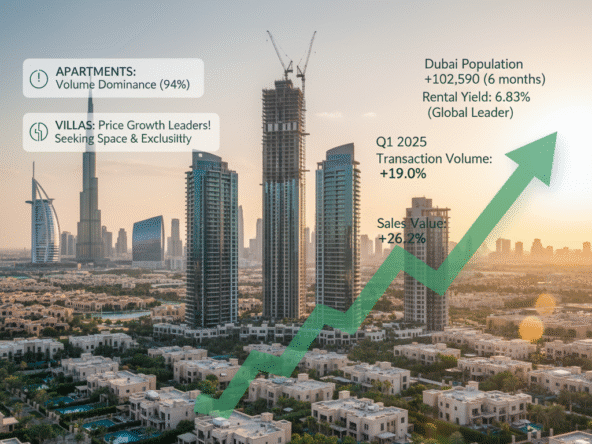

Dubai’s population growth has now surpassed 4 million, and if you’ve experienced the traffic lately, it’s clear the city is expanding rapidly. However, this growth isn’t happening haphazardly; strategic investments in new roads, infrastructure, and master planning are effectively managing the city’s swift development.

Against this backdrop of growth, Dubai’s prime residential market, defined by Savills as the top 5% to 10% of property prices across each city, continues to deliver. According to Savills’ World Cities Prime Residential Index, values rose by more than 5% in the first half of 2025, with a further 4% to 5.9% increase forecast for the second half. That places Dubai among the world’s strongest performers, ranked just behind Tokyo, Seoul and Cape Town.

So, in case no one else has told you, we will: wealth is flowing east. The question is why… and the answer lies in the fundamentals that are pulling in global wealth while other cities push it away.

Why are high-net-worth individuals moving to Dubai real estate?

Dubai’s real estate market in 2025 presents a compelling case for investors and residents alike. The city’s strategic positioning, coupled with investor-friendly policies and a robust infrastructure, continues to attract global attention.

Key Highlights

- Population Growth Dubai’s population has surpassed 4 million, reflecting a 5% year-on-year increase, driven by both expatriate influx and natural growth. Deloitte

- Economic Expansion The UAE’s GDP is projected to grow by 4.9% in 2025, bolstered by increased oil production and a thriving non-oil sector. Reuters

- Real Estate Transactions In the first half of 2025, Dubai recorded AED 431 billion in property sales, marking a 25% increase compared to the same period in 2024. Wikipedia

- Prime Property Appreciation Savills reports that prime residential values in Dubai rose by over 5% in H1 2025, with forecasts suggesting an additional 4% to 5.9% growth in the latter half of the year. haus & haus+1

- Wealth Migration The Henley Wealth Migration Report anticipates that approximately 9,800 millionaires will relocate to Dubai in 2025, contributing to the city’s status as a global wealth hub. Aurantius Real Estate

- Supply Dynamics Dubai plans to add 73,000 new homes in 2025, aiming to meet the growing demand driven by population growth and investor interest. The Times of India

Investment Considerations

While the market shows strong fundamentals, it’s essential for investors to conduct thorough due diligence. The influx of new developments may lead to an oversupply in certain segments, potentially affecting rental yields and capital appreciation. Focusing on prime locations and established developments can mitigate these risks.

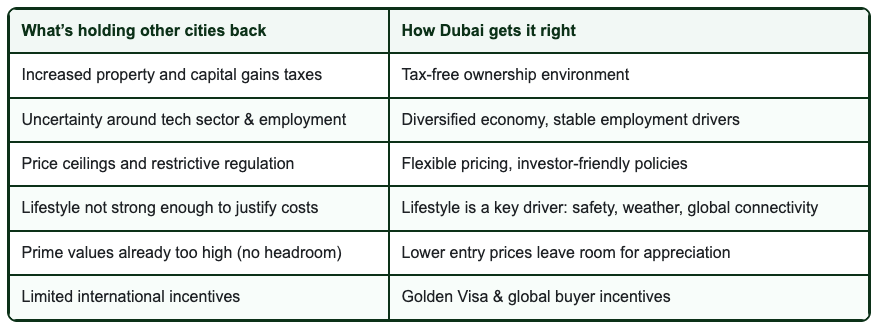

Why are investors leaving London, Paris and other global property markets?

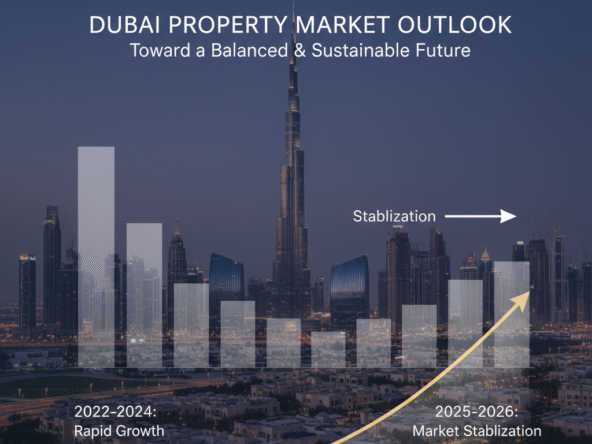

TThis story isn’t just about Dubai’s strength. It’s also about the cracks showing elsewhere. Globally, acceleration in price growth slowed from 2.2% for the full year in 2024 to just 0.7% in the first half of 2025.

In London, higher stamp duties continue to weigh on demand. In Paris, rent caps have tightened supply. And in the United States, high mortgage rates, elevated prices and wider economic uncertainty have slowed luxury market activity. According to Savills, several of the world’s biggest and most expensive cities — including London, Paris, Shanghai and Los Angeles — even recorded negative prime capital value growth in H1 2025.

These are not dramatic declines, but they show how regulation, high costs and volatility are eroding confidence in markets once seen as bulletproof.

Here’s Dubai’s population growth and the contrast at a glance

While other cities struggle with policy headwinds and affordability barriers, Dubai keeps climbing the ladder by giving investors room to grow.

Dubai property market 2025 and the role of scarcity on growth

Dubai isn’t just a market with strong numbers; it’s a market where pressure is baked in on both sales and rentals. New projects are coming online, but demand is running ahead of deliveries.

The squeeze is clearest in waterfront properties and villa/townhouse stock, which make up a relatively small slice of the market but attract outsized demand. Every launch that redefines “prime” is met with immediate absorption, leaving villas and quality stock in chronic short supply.

Dubai has already posted more than 5% growth in H1 2025, with a further 4% to 5.9% expected in H2. That means the city has delivered one of its best quarters on record in Q2 2025 and remains firmly among the top-performing global markets. Scarcity is part of the story, but in Dubai, fundamentals like population growth, immigration and investor demand are amplifying the effect in a way few other cities can match.

It’s basic economics: more buyers, fewer homes, higher prices. So, until supply can catch up, both sales and rentals will remain under upward pressure, with Dubai’s fundamentals amplifying the effect in a way few other markets can match.

Dubai’s housing demand: 350,000 new homes needed by 2030

That imbalance is only set to grow. According to the Government of Dubai, the current population has already passed 4 million.

Based on the trajectory we’re seeing, projections suggest it could reach 5 million by 2030. That means more than 1 million new residents before the decade concludes, creating demand for as many as 350,000 new homes, according to DXBinteract.

For investors, the message is that this isn’t a temporary surge in demand. It’s a structural shift driven by sustained economic growth, global talent inflows and long term urban planning. More people, more families and more wealth all mean one thing: a long runway for property demand in Dubai.

What’s the next step if you want to invest in Dubai property?

Dubai’s story is bigger than one good year. It’s about long term growth powered by population, investment and global confidence. For investors, that creates real opportunity, but it also raises questions: where to buy, what to avoid and how to build for the future.