Dubais real estate market has once again defied the naysayers, with Q3 2025 total sales values climbing 16.61% year-on-year (YoY). While the numbers remain positive, our experts note that eventual stabilisation is inevitable and that is no cause for concern.

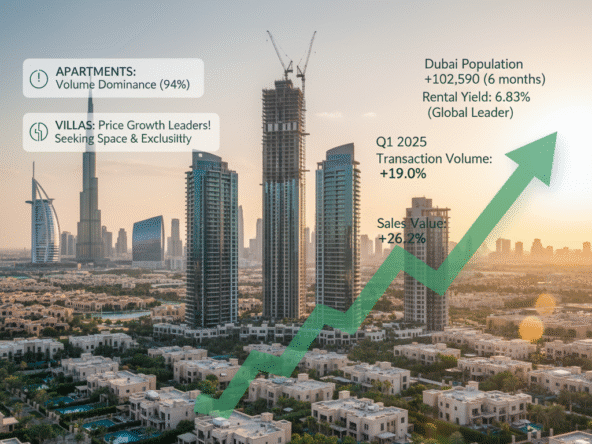

Real estate is always about the balance of supply and demand, and although speculation about oversupply persists, Dubai’s policies and long term vision act as a safety net. Yes, there are a significant number of new units coming to market, but the pace of population growth is extraordinary, rising at a rate that would be incomprehensible in most cities.

Dubai’s property story isn’t just about growth. It’s about balance, maturity and the right opportunity. Here’s what the latest numbers tell us and what they mean for those investing in the city’s future.

Dubais real estate market Understanding Q3

Dubai’s Q3 2025 results show strength across every major segment, with total sales value reaching AED 178.38 Bn and residential sales climbing to AED 56.48 Bn (+9.48%) across 16,328 transactions.real estate market Stabilization

A population already past 4 million means demand for housing, schools, offices and retail all moves in tandem. A 29.2% rise in commercial sales to AED 30.07 Bn reflects a city where businesses are expanding, families are settling and people are choosing Dubai as a place to build their future. The growing number of schools with waiting lists shows families are planning to stay, not just invest.

Rising prices per sq.ft mirror that sentiment, showing buyers are invested in the city’s continued growth.

“People say the market’s slowing, but just look at the traffic,” said Simon Baker, Managing Director at haus & haus. “Schools have waiting lists for new students. That doesn’t say slowdown to me, it says demand.”

What does it mean if a market stabilises?

When people talk about stabilisation, it often gets confused with a slowdown, but they are not the same thing. A stable market is a healthy one. Prices cannot rise indefinitely and at some point, values must level out to ensure the city remains livable and sustainable.

If property prices continued climbing at record pace, Dubai would risk becoming unaffordable for the very people who keep its economy thriving: the families, professionals and entrepreneurs choosing to call it home.

From a broader perspective, stabilisation means better pricing, stronger negotiation power for buyers and a more balanced relationship between supply and demand. It allows investors to make smarter decisions based on value, not urgency, and it ensures that settling residents can continue to buy, rent and live comfortably in a growing city.

Why we say the market will stabilise

If Dubai’s population is set to reach 5.8 million by 2030, then housing supply must rise accordingly.

According to data from Property Monitor and the Dubai Land Department (DLD), more than 85,000 units were scheduled for completion in 2025, yet only around 28,000 have been handed over and a further 10,000 are nearing completion. While Dubai’s pace of development means new supply will continue to enter the market, this is still less than half the initial forecast. At the same time, the city’s population is growing at a rate few others in the world can match. Growth on this scale demands more housing, not less.

The city is not facing an oversupply problem, it is evolving to meet demand. Unlike global hubs such as Los Angeles, which continue to struggle with housing shortages, Dubai is building ahead of the curve with infrastructure, schools and communities designed to accommodate the next wave of residents.

How investors can protect their Dubai assets

The best way for investors to safeguard themselves and their assets in this evolving market is by knowing where to invest for long term ROI. That is where expert guidance matters most, helping you identify projects and communities that offer sustainable growth rather than short term gains.

What sets a successful investor apart is not just buying property but buying the right property. Some key things to consider for your next investment are scarcity, brand strength, developer reputation and location specifics… all factors that hold their value through every phase of the cycle.

haus & haus sales value up 19.85% YTD

haus & haus’ own results mirror the citywide momentum. Year-to-date, sales value is up 19.85% compared to 2024 and Q3 transactions rose 5.6% year-on-year. Registered buyers increased by 16%, showing continued confidence among investors and end users.

Even with 29.25% fewer properties listed for sale quarter-on-quarter, transactions have continued to rise, proving that well-priced homes in the right communities are still moving. Market appraisals are also up 18.55%, as more sellers turn to haus & haus for expert valuations and strategic advice. Taken together, the data paints a picture of resilience: fewer homes listed, more deals closed and more qualified buyers entering the pipeline.

Area-specific data matters

At haus & haus, we deliberately operate in segments we know are lucrative, livable and resilient. Our area-specific market reports give you a sharper lens on what’s happening in your neighbourhood, rather than broad market reports that place Deira on the same footing as Arabian Ranches. These areas have completely different dynamics and decisions should reflect that.

“Two neighbourhoods can perform completely differently,” said Jake Walton, Leasing Director. “That’s why area-level insight is more valuable than broad market averages.”

Stabilisation, when it comes, will be a natural part of that story, not a signal to step back, but a reminder to make well-studied investment decisions.

Download our Q3 2025 Market Reports to see how your community performed, then speak with a osacpropeties area expert to plan your next move.